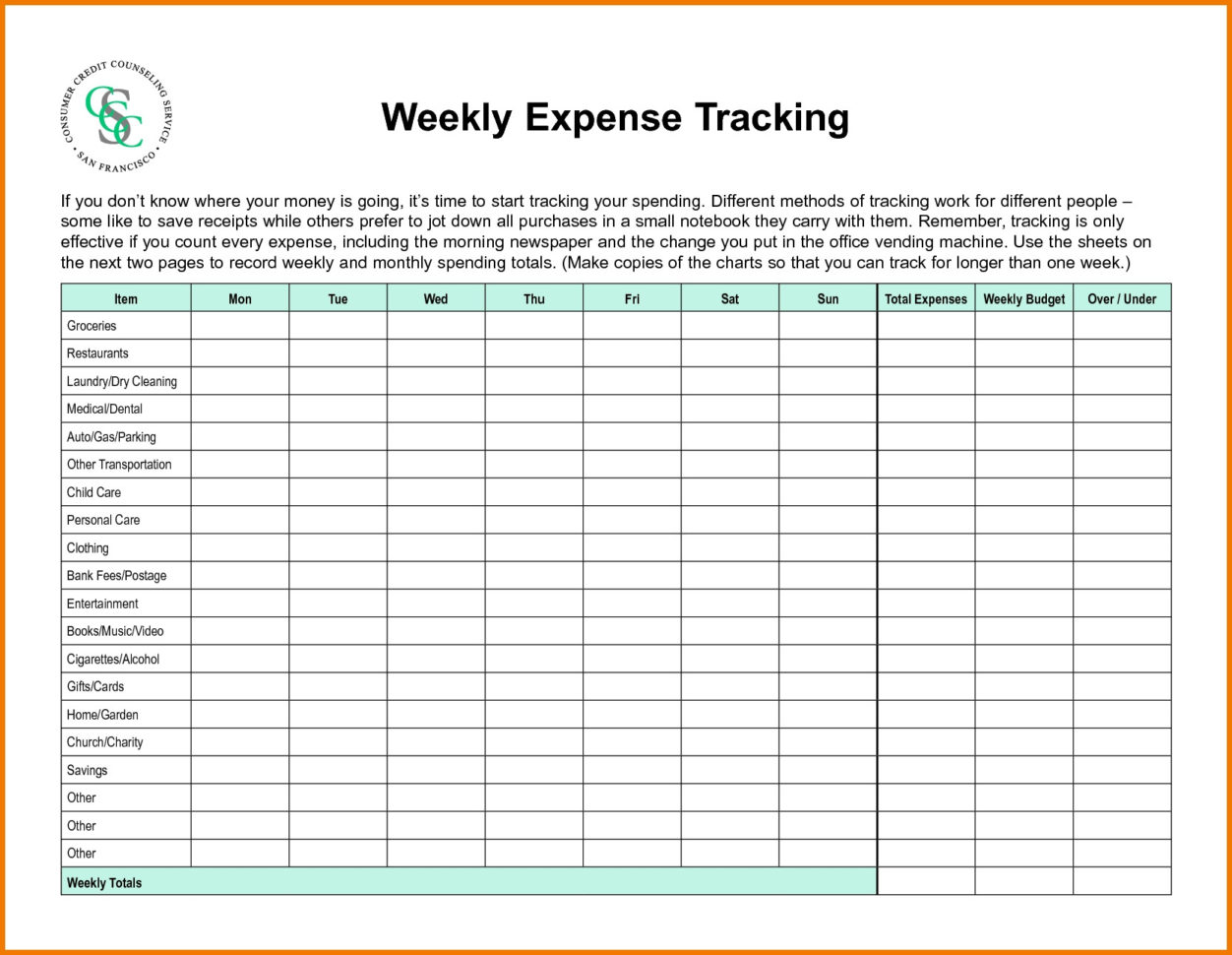

However, if you need structure, this approach isn’t your best option. If you find you are not able to stick to your budget, it may mean you are spending beyond your means or that your budget is not flexible enough. If you often struggle to complete your goals or make progress, this budgeting method may be the right one for you. The next step is to create your monthly budget using this basic Budget Worksheet. Disposable income is the money you have left over after you subtract your income taxes from your income.Total monthly income is the income from your job or other resources including investment dividends, pensions, Social Security benefits, rental income and more.Total expenses are the combined amount of your fixed and flexible expenses.Flexible expenses are expenses that change from month to month, such as how much you spend on utilities.Fixed expenses are expenses that stay the same from month to month, such as rent payments.Ready to get started? Understanding the following key components will help you as you begin to build a monthly or annual budget: Revisit and rework your budget if you have a financial windfall or setback so it reflects your current situation.

Creating a budget and sticking to it can help you save and reach your short- and long-term financial goals. Acknowledging areas where you are overspending can be an eye-opening experience. A budget is a financial plan that takes income and expenses into account and provides estimates for how much you make and spend over a given period of time.Īddressing your financial situation and distinguishing between needs and wants is an important first step before creating your annual budget. If you’re new to budgeting, it’s important to understand what a budget is and how it helps you examine what you earn and how you are spending that income.

0 kommentar(er)

0 kommentar(er)